Leaked Credit Cards 2024: Understanding The Risks And Prevention Strategies

The year 2024 has brought new challenges in the realm of cybersecurity, particularly concerning leaked credit cards. As technology advances, so do the tactics employed by cybercriminals, making it increasingly essential for consumers to be aware of the risks associated with leaked credit card information. With the rise in online transactions, the potential for financial loss due to compromised credit card data has become a significant concern for individuals and businesses alike.

This article will delve into the intricacies of leaked credit cards, exploring the methods by which sensitive information is obtained, the implications for consumers, and effective prevention strategies. Understanding these elements is crucial for safeguarding one’s financial health and maintaining trust in online transactions.

Moreover, we will provide insights into the current landscape of cyber threats, backed by data and statistics to illustrate the severity of the situation. By the end of this article, you will be equipped with knowledge and tools to protect yourself from the dangers of leaked credit cards in 2024.

Table of Contents

- What Are Leaked Credit Cards?

- How Do Credit Cards Get Leaked?

- Impact on Consumers

- Preventive Measures for Consumers

- Role of Banks and Issuers

- Legal Implications of Credit Card Leaks

- Emerging Trends in Cybersecurity for 2024

- Conclusion

What Are Leaked Credit Cards?

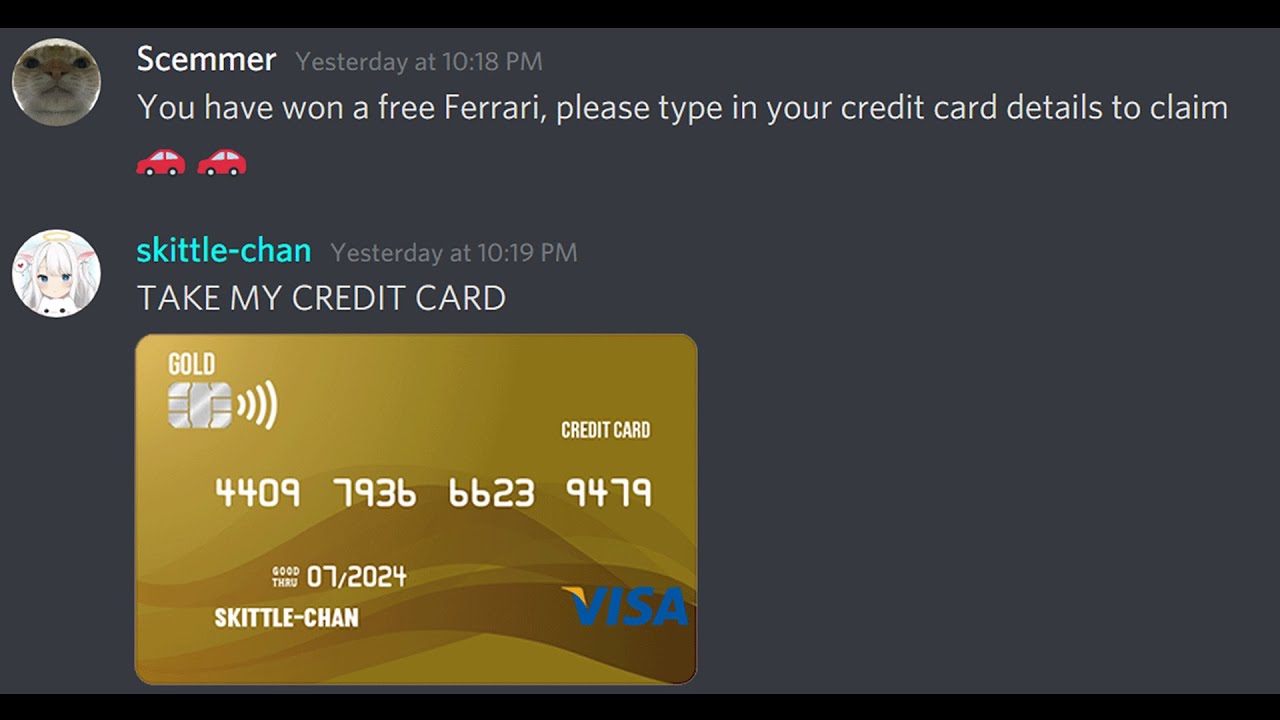

Leaked credit cards refer to instances where credit card information is exposed to unauthorized entities, often through data breaches or cyberattacks. This information can include card numbers, expiration dates, security codes, and even personal identification details linked to the cardholder.

When these details are leaked, they can be sold on the dark web or used directly for fraudulent transactions, putting consumers at financial risk. It is paramount for individuals to understand the implications of such leaks and take proactive measures to protect their financial information.

Key Characteristics of Leaked Credit Cards

- Card Number: The 16-digit number that identifies the card.

- Expiration Date: The date until which the card is valid.

- CVV Code: The three-digit security code on the back of the card.

- Cardholder Name: The name of the person to whom the card is issued.

How Do Credit Cards Get Leaked?

Credit cards can be leaked through various channels, including but not limited to:

- Data Breaches: When companies storing sensitive customer information fall victim to cyberattacks, hackers can gain access to credit card data.

- Phishing Scams: Cybercriminals often use deceptive emails or websites to trick individuals into providing their credit card information.

- Malware: Malicious software can be installed on devices to capture credit card information during online transactions.

- Public Wi-Fi Networks: Using unsecured Wi-Fi connections can expose users to risks as data transmitted over these networks can be intercepted.

Impact on Consumers

The repercussions of leaked credit card information can be devastating for consumers. The immediate effects often include unauthorized transactions, leading to financial losses that can take time to resolve. Additionally, consumers may experience long-term damage to their credit scores and increased stress related to identity theft.

According to a report by the Identity Theft Resource Center, over 1,000 data breaches were reported in 2023 alone, affecting millions of consumers. The financial impact of these breaches can amount to billions of dollars in losses each year, making it essential for consumers to stay informed and vigilant.

Emotional and Psychological Effects

- Increased anxiety and stress related to financial security.

- Distrust in online transactions and e-commerce platforms.

- Fear of identity theft and ongoing monitoring of financial statements.

Preventive Measures for Consumers

To mitigate the risks associated with leaked credit cards, consumers should adopt several preventive measures:

- Use Strong Passwords: Create complex passwords for online accounts and change them regularly.

- Enable Two-Factor Authentication: This adds an extra layer of security to online transactions.

- Monitor Financial Statements: Regularly check bank statements for unauthorized transactions.

- Utilize Virtual Credit Cards: Some banks offer virtual card numbers for online transactions, reducing the risk of exposure.

Role of Banks and Issuers

Banks and credit card issuers play a crucial role in protecting consumers from the dangers of leaked credit cards. They implement various security measures, such as:

- Transaction Alerts: Sending notifications to cardholders for any transactions made using their cards.

- Fraud Detection Systems: Utilizing advanced algorithms to flag suspicious transactions in real-time.

- Chargeback Protections: Allowing cardholders to dispute unauthorized transactions and recover lost funds.

Collaboration with Law Enforcement

Banks often collaborate with law enforcement agencies to track down cybercriminals and prevent future breaches. This partnership is essential for creating a safer online environment for consumers.

Legal Implications of Credit Card Leaks

Leaked credit cards can lead to severe legal consequences for both the perpetrators and the companies that fail to protect consumer data. Many jurisdictions have enacted laws requiring companies to notify customers in the event of a data breach, as well as to implement robust security measures to safeguard sensitive information.

Consumers also have the right to pursue legal action against companies that do not adequately protect their data, which can result in significant financial penalties for the organizations involved.

Emerging Trends in Cybersecurity for 2024

As we move further into 2024, several trends are emerging in the realm of cybersecurity that may impact the landscape of leaked credit cards:

- Artificial Intelligence in Fraud Detection: The use of AI and machine learning algorithms to identify fraudulent activities is on the rise.

- Increased Regulation: Governments are expected to introduce stricter regulations regarding data protection and cybersecurity.

- Consumer Education Initiatives: Companies are more focused on educating consumers about cybersecurity risks and prevention strategies.

Conclusion

In conclusion, the issue of leaked credit cards in 2024 poses significant challenges for consumers and financial institutions alike. By understanding how credit card information is leaked and the potential impacts, individuals can take proactive steps to protect themselves.

We encourage readers to stay informed about cybersecurity trends and to adopt preventive measures to safeguard their financial information. If you have experienced issues related to leaked credit cards, we invite you to share your experience in the comments below or reach out to your financial institution for assistance.

Call to Action

Don't forget to share this article with friends and family to raise awareness about the risks associated with leaked credit cards. Explore our other articles for more insights on cybersecurity and financial safety.

Thank you for reading, and we hope to see you back here for more informative content!

FCI Florence News: Latest Updates And Insights

Megan Trainor Nude: A Comprehensive Look At Her Journey And Impact

Understanding Japanese Nicknames: A Cultural Insight